Table of Contents

Inside this article

#1. Introduction to licensed money lenders in Singapore

When you’re living in one of the most expensive countries in the world, being short on cash can be an issue for many, especially when one has to pay off essential bills like monthly mortgage, utility bills, emergency vehicle repair costs or hospital fees.

In these cases, many may turn to applying for a loan from a bank, but local banks tend to have a long processing time and stringent rules. For borrowers looking to get an instant cash loan, a quick and reliable money lender in Singapore is your best bet.

Licensed money lenders in Singapore are regulated by the Ministry of Law and have to adhere to the Moneylenders Act when conducting their business. Legitimate, authorised money lenders in Singapore are always found in the list of licensed money lenders from the official Registry of Moneylenders with a unique licence number that shows their legitimacy.

#2. How to avoid loan scams by illegitimate money lenders in Singapore

With the rise of loan scams in Singapore, it’s important to differentiate between illegitimate and trusted legalised money lenders in Singapore. To avoid money lender loan scams, it is recommended to verify the local money lender’s licence before proceeding with any loan application. Here are some other ways to identify a possible scam.

HOW TO IDENTIFY A LOAN SCAM

Licensed Money lender

Illegitimate Money lender

Has a registered money lender licence number in the Registry of Moneylenders

Does not have a registered licence number

Has a registered physical office address

May not have a physical address

Must include a face-to-face interview in the lender’s office before the money is disbursed to you

Will usually request an entirely remote or online loan application process and loans can be disbursed without meeting face-to-face

Only allowed to advertise on their websites, consumer or business directories, and at their registered offices

May advertise through SMS, WhatsApp, Telegram, emails, unsolicited calls

Prohibited from threatening clients. Licensed money lender harassment could result in loss of licence

May use threats, harassment, and violence as a method for debt collection

It’s important to read up about legal money lenders, such as what a money lender’s licence would entail and prohibited practices that may be a sign of an illegitimate money lender, so you can better identify a reliable and trusted money lender in Singapore to avoid scams. At Galaxy Credit, we share our knowledge with readers on our blog so they can make informed decisions when borrowing from a licensed money lender. Check it out below.

#3. Banks vs legal money lenders in Singapore

While it is always recommended to attempt to get a loan from a bank first, a private money lender loan from a legal money lender in Singapore is also a reliable option for your consideration. On top of being a feasible option, instant money lenders are even able to provide speedy loan disbursements for those in need of urgent cash.

It is a known fact that banks are more affordable as private money lenders’ interest rates can be pricey for many in Singapore. However, not all candidates may get their bank loans approved and that is when reliable money lenders in Singapore may be of help.

For a clearer understanding on the differences between a bank and an authorised money lender in Singapore, refer to this handy table below.

DIFFERENCES BETWEEN BANKS AND LICENSED MONEY LENDERS

Banks

Licensed money lenders

Provide loans up to 10 times monthly income

Provide loans up to 6 times monthly income

Minimum annual income requirement for Singaporeans & PRs: $20,000

Minimum annual income requirement for foreigners: $45,000

Will offer loans to borrowers with an annual income of less than $10,000

Average interest fee of 3.5 – 6% per annum

Interest fees can range from 1 – 4% per month

Repayment period of up to 7 years

Repayment period of up to 12 months

Requires a good credit score for loan approval

Does not require a good credit score

Allows online loan applications

Loan applications can be done online when borrowing from online licensed money lenders, but face-to-face verification in the lender’s office is still required before a loan can be disbursed

#4. Why you should approach a legal online money lender in Singapore

BENEFITS OF BORROWING FROM A RELIABLE LICENSED MONEY LENDER IN SINGAPORE

Fast approvals

Borrowers can make an enquiry with a reliable online money lender in Singapore on the website, visit the branch office for a short interview, and collect their loan in a single day. An in-person application at the fast money lender’s office can be completed in less than 30 minutes.

Bank applications usually take a few days or more.

Less strict on credit scores

Legal money lenders in Singapore usually do not check borrowers’ credit scores when approving a loan. Borrowers with bad credit scores can still get their loans from money lenders approved, but usually at higher interest rates.

Banks will not accept borrowers with a bad credit score.

Flexible loan agreement

If you require an extension on your loan, you can negotiate your loan terms and fees with your trusted money lender in Singapore.

Banks have a fixed late fee that is non-negotiable.

#5. When you should NOT approach a private money lender in Singapore

While legalised instant money lenders in Singapore are a great option for those looking for a quick loan with a bad credit score, not all borrowers are suitable to take a loan from a money lender.

You should not approach an online licensed money lender in Singapore if:

1. You are unable to pay on time

While it is advised to never miss any of your payments whether you are borrowing from a licensed money lender or a bank, the consequences are much dire if you’re unable to pay a money lender in Singapore.

Private legitimate money lenders have high interest rates and even higher late fees as these enterprises bear a higher risk running their businesses compared to banks.

Unfortunately, this can greatly affect borrowers who have a history of late repayment and long-term debt. If you tend to defer your payments, work on managing your finances before approaching a registered money lender.

2. You have a good credit score

Instant, legal money lenders are usually an option for those with a bad credit score as they are less strict on borrowers’ credit scores. If you have a stable monthly income and a good credit score, it is recommended to apply for a loan with a bank as they generally have much lower interest rates that will help with your finances in the long run.

Here’s how you can obtain your credit report with Credit Bureau Singapore (CBS).

3. You have multiple loans and want to take another

To manage your finances well, you should never apply for a loan with a private money lender in Singapore that exceeds your financial capabilities. Reaching out to various local money lenders for multiple loans may also increase the responsibility and stress of repaying them. This could lead to you deferring your payments and landing yourself in even deeper debt, especially with the high interest rates and fees of legalised local money lenders in Singapore.

However, if you have multiple loans with a legalised money lender in Singapore, the only loan that might be suitable for you is a debt consolidation loan. A debt consolidation plan with a reliable and fast money lender helps you combine all your loans into a single loan with a single lender, often with a lower interest rate, which would be much easier to manage and repay.

#6. What to enquire with licensed money lenders in Singapore to avoid being overcharged

Licensed online money lenders in Singapore can charge their borrowers through several legitimate means: interest rates, late interest rates, late repayment fees, and administrative fees.

It’s important to go through your contract and loan terms thoroughly and be aware of the possible fees you can be charged. Take note of your repayment date to avoid incurring extra late charges. Under the Ministry of Law, licensed online money lenders in Singapore have a cap on the fees they can charge. Make sure your money lender is not overcharging you by cross checking with the table below.

Chargeable fee

Maximum charged

Interest rate

4% per month (48% p.a.)

Late interest rate

4% a month (48% p.a.) for the amount that was not paid on time, excluding any loan amount that’s not yet due

Late repayment fee

$60 for every month of late repayment

Administrative fee

10% of the principal loan amount

#7. The different types of loans private money lenders in Singapore offer

Licensed money lenders offer both secured and unsecured loans. Secured loans are often used for vehicle and property purchases while unsecured loans are more flexible if you are taking a personal loan – this can be used for personal reasons including paying off credit card bills, renovation expenses, or tuition fees.

Secured loans require collateral (such as a car or property) to be pledged, which can be seized by the lender if the borrower is unable to pay off their loans.

If you’re deciding between a secured and unsecured loan from a legalised money lender in Singapore, here are the differences between the two:

SECURED LOAN

UNSECURED LOAN

- Has a bigger loan amount with lower interest rates

- Has a smaller loan amount with higher interest rates

- The borrowing limit for home loans and car loans is subject to a maximum TDSR of 55%.

- HDB and EC loans are subject to an MSR of 30%.

- Car loans’ LTV is kept at a maximum of 60-70%.

- Has a borrowing limit depending on the borrower’s income and citizenship

- Requires declaration of collateral

- Does not require collateral

- Fixed loan use for vehicle/property purchase.

- Flexible loan use (if personal loan)

- Easier to obtain even with bad credit history

- Easier to get with a favourable credit history

- May take a few more days to process

- Fast loan disbursal, can be done under 30 minutes if all documents are in order

Here are the types of loans that you can apply for with reliable money lenders in Singapore, depending on your financial needs:

- Personal loan

- Business loan

- Bridging loan

- Debt consolidation loan

- Wedding loan

- Payday loan

- Study loan

- Renovation loan

- Vacation loan

- Grab/Gojek loan

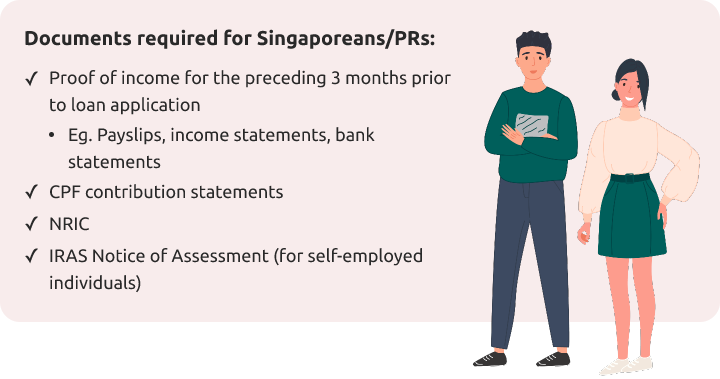

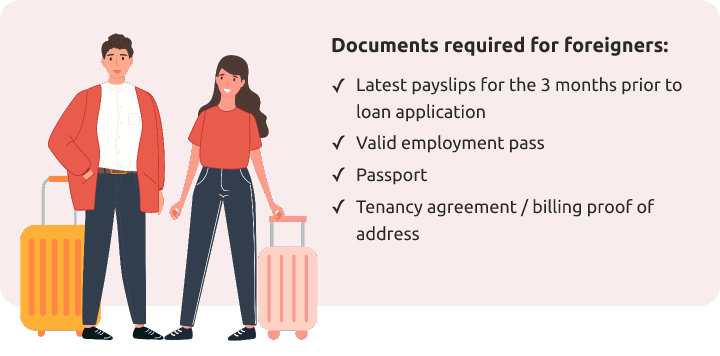

#8. How to apply for a loan with a legal money lender in Singapore

Before applying for your instant loan from a money lender, remember to compare online licensed money lenders and their different rates, loan tenures and repayment schedules. Loans with lower interest rates are not necessarily the best – if loan tenures are short, it means a higher repayment amount per month.

So, get in touch with a reliable money lender in Singapore and pick one with an interest rate, loan tenure, and monthly repayment amount that is comfortable for your situation and needs.

#9. Reasons why private money lenders in Singapore may reject your loan

There are times when a borrower may submit the required documents but still get their loan with legitimate money lenders rejected. Here are some reasons why this could happen even with quick money lenders:

1. You do not have an income

When applying for a loan with a private money lender in Singapore, you will be required to prove you have a steady source of income. Without one, you will be considered a risky borrower who may not be able to repay your loan. So, always prepare the needed documentation that proves you have a regular source of income.

Your income does not need to come from full-time employment. It could also come from various part-time jobs or even rental income.

2. You deferred your past loan repayments

While money lenders may not access your credit report from the Credit Bureau Singapore during the loan application, they will check your borrowing history with other lenders through the Money Lenders Credit Bureau (MLCB).

If you have an unfavourable history of deferring past loan repayments, future lenders may not take the risk of offering you a loan.

3. You applied for too many loans within a short time frame

Lenders will also be able to check the number of loan applications you have made with other money lenders through MLCB. When a borrower has applied for several loans within a short span of time, this is usually a red flag for the lender.

Legitimate money lenders avoid such clients as borrowers who have multiple loans have a higher risk of skipping their loan repayments.

4. You have filed for bankruptcy

If you were unable to pay off your past loans, you might have been advised to file for bankruptcy. However, filing for bankruptcy can impact your financial future, including the approval of any future loan.

5. A past money lender has taken legal action against you

Authorised money lenders in Singapore can file for litigation against their borrowers if they are unable to repay their loans according to the signed loan contract’s terms. In such cases, the borrower’s legal history will be on record and other lenders will be able to access them. If a lender has taken legal action against a client, future money lenders are more likely to avoid them.

#10. Apply for a loan with a trusted licensed money lender in Singapore

At Galaxy Credit, we offer flexible personal loans including medical, business, and study loans.

As one of the top-rated quick money lenders in Singapore, we provide instant loans for emergencies and pride ourselves on being a reliable and competitive loan solution provider.

Keen to apply for a loan? Drop us a loan enquiry and we will get back to you within one working day.